Scoring and risk assessments can still continue until these provisions of healthcare reform come into place in a few years. With reform, carriers can adjust their  algorithms up and down so the parameters to be met can change. We have no idea on what they are but I have said in the past such sets of algorithms on “scoring” patients and potential candidates should be under some type of audit or certification trail so we have some idea as to what parameters our poor little bodies have to meet to get the OK. The more predictive algorithms a company uses, the more it seems to excite investors as they might be assured only the “healthiest” of bodies will be included so less payouts for care.

algorithms up and down so the parameters to be met can change. We have no idea on what they are but I have said in the past such sets of algorithms on “scoring” patients and potential candidates should be under some type of audit or certification trail so we have some idea as to what parameters our poor little bodies have to meet to get the OK. The more predictive algorithms a company uses, the more it seems to excite investors as they might be assured only the “healthiest” of bodies will be included so less payouts for care.

BioBehavioral Diagnostics Attracting Investors –ADHA Diagnosis Technology – Diagnosis Process for Politicians?

Even at the big DAVO convention, it was discussed on how algorithms are running our lives and all decision making processes are not created equal. In health insurance this is another profit center on selling some of your personal data that is not tied to HIPAA regulations. Melinda and Bills Gates though are truly use algorithmic formulas to do good things as their focus is fighting disease.

Do Algorithms Run Your Life – Bill and Melinda Gates Foundation Commits $10 Billion for Vaccine Research Over the Next 10 Years To Use Them Wisely And Save Lives – Davos 2010

Milliman's Intelliscript or Ingenix Medpoint are the 2 big data miners that find out when you apply for health insurance what your medication rap sheet has been for the last 5 years. By applying for insurance, you sign a release to allow the companies to mine the information, no signature and permission, then probably no insurance will be written for you; however, the release you sign is HIPAA compliant, whatever that constitutes at this point.

Health Insurance Underwriting procedures – Data Mining to Cherry Pick and some are listed on the Web

Some of the resources used by carriers include the MIB, Medical Insurance Bureau that has been around for years and recently is becoming their own software store offering additional algorithmic formulas for “scoring” potential applicants. You can get your own file from them and it is a good idea to check and see what is there as there’s a chance you could uncover some real errors too as this is data input from others that you as a patient have not done yourself.

HIPAA does not give the Department of Health and Human Services the ability to directly investigate or hold accountable entities, such as pharmacy benefit managers or companies such as Ingenix and Milliman, who are not covered by HIPAA.”

What is the MIB - Medical Insurance Bureau - and how does it affect qualifying for insurance?

How can insurance companies find out if you have a pre-existing condition - The MIB

Health Insurers Show 14 Percent Increase in Use of MIB Data

It is sometimes a huge element of surprise when one learns of what is floating out  there and the link below shows additional efforts of the MIB and a couple others.

there and the link below shows additional efforts of the MIB and a couple others.

The MIB – Health Insurance Bureau Business Intelligence Mining May Go Beyond Just Healthcare Information

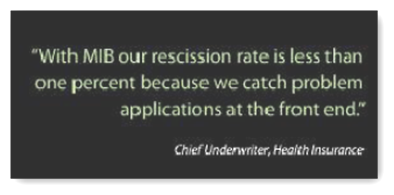

In the past we used to see statements as such on their site because they caught the “sick” employees who would be costly at the front end, not really good bragging rights if you have chronic conditions and need care but this is what they put out on the web for all to read. THIS BASICALLY SAYS WE CATCH THOSE UNHEALTHY CONSUMERS BEFORE A CARRIER GIVES THEM INSURANCE. The MIB is a tool insurers use to find pre-existing conditions even if the patient does not list them.

You can read more here: (This is from the website and they are talking about their high performing algorithms that will catch all those folks and say no before a carrier risks getting someone on board where they may have to pay out more than desired algorithms calculate for profit.

“With Audit Focus you can:

- Look at every new policy from every ceding company

- See which cases are outside of your risk tolerances

- Quickly identify risk concentrations and prevalence of unexpected medical conditions

- Identify high-risk cases by ceding company to prioritize audits

- Monitor those companies you are unable to audit

- View reports by your most important metrics

- Better manage risk for improved financial performance

A Security Alert search is automatically performed on every applicant run through the MIB Checking Service data base – this offering is a useful adjunct to check name assignments beyond underwriting such as policyholder and beneficiary changes, claims, etc. Both our web-based Transactional Service and outsourced Portfolio Sweeps use MIB’s precise name search technology. Security Alert Services gives companies the flexibility they require to meet their unique needs.”

Notice the word transactions above, there's a cost for this. There’s a ton of money spent in this area is this is by far one of the largest areas of cost with healthcare. When I say “machine guns” I mean “data machine guns”, aka “The Algorithms”. This exists today all over Wall Street too as they are the partners of healthcare for profit and make sure the dividends are paid out accordingly and shareholders are kept happy.

In summary, this is why so many get denied coverage as if one is not healthy enough and looks to need some big dollar care, you are not adding to a carrier's bottom life profits, and this is one reason I believe health insurance should be a non profit business. BD

The four largest U.S. for-profit health insurers on average denied policies to one out of every seven applicants based on their prior medical history, according to a congressional investigation released Tuesday.

Two top House Democrats said the findings covered 2007 to 2009 for Aetna Inc., Humana Inc., UnitedHealth Group Inc. and WellPoint Inc. In total, the carriers denied coverage to more than 651,000 people due to pre-existing medical conditions over the three-year period.

Under the health-care overhaul legislation, beginning in 2014 insurers can no longer deny coverage because of a pre-existing health condition.

0 comments :

Post a Comment